Historically the photoelectric effect has been known for a couple hundred years ever since it was observed in elemental Selenium around the turn of the 19th century. It became practical to use the photoelectric effect to generate power with the development of the transistor in 1947 that lead directly to Germanium (and later Silicon) solar cells that could produce a useful amount of electricity. Early solar cells saw use in extreme applications, such as providing power for satellites. Serious efforts to develop photovoltaic cells for commercial power production wasn't undertaken until the Arab oil crisis's of the 1970s. The USA developed an early dominance in the technology, but that advantage withered as the memory of the oil crisis faded from public view and successive administrations ignored the technology. More recently interest in photovoltaics has been rekindled due to concern around global warming, predominately supported by programs in Germany and Japan, whose domestic manufacturers now produce the bulk of solar cells. Research and development in photovoltaic technology is proceeding at a frenzied pace, as triple-junction thin-film silicon and Copper-Indium-Gallium-Selenide (CIGS) cells are posed to take over market share from traditional polycrystalline silicon wafers sawed from solid ingots. In the future decades,

nanotechnology and

organic semiconductors offer the potential for new generations of solar power technology.

Photovoltaic cells are not like any other method humanity uses to collect and use energy. Existing techniques extract energy either from mechanical motion (wind, hydroelectric, tidal) or heat differentials (fossil fuels, nuclear, solar-thermal). Whereas all these systems produce useful work by the turning of a shaft photovoltaics convert sunlight directly into direct-current electricity. While photovoltaics are still beholden to the laws of thermodynamics and entropy, the difference still implies that they abide by difference rules. In particular, they have a total absence of moving parts and as a result are almost free of maintenance requirements. Photovoltaic cells degrade in performance only very slowly as they are bombarded by cosmic rays. Most manufacturers offer warranties that guarantee they will still reach 80 % of their rated power output after 25-years.

Photovoltaic Share of the Energy Pie

A report by Merill Lynch (Hat-tip to

Clean Break) found that between 2200-2500 MW

peak worth of solar cells were manufactured in 2006 [1]. Taking the median value of 2350 MW

peak and a capacity factor (cf) of 0.2, which is typical, then the annual electricity capacity was 4 million kWh. According to the Energy Information Administration (US DoE), the world produced 16,400 billion kWh of electricity in 2004, and that figure is growing at 3.2 % a year since 1994. If we extrapolate to 2006 at 4 % growth then the total electricity production was an estimated 17,950 billion kWh. Photovoltaic power consists of only about 0.6 % of the annual growth in electricity capacity.

It seems minute, and it is, for now. However, solar production hasn't been growing at 3.2% per year. It has, in fact, been growing at 33 % per annum for the last decade [2], and it's expected to continue that trend for the immediate future. The cumulative installed capacity can be expressed as

C(t) = Co e(γ-δ)(t-to)/(γ-δ)

where C(t) is the cumulative installed PV electricity generation capacity, C

o is the initial installed capacity, γ is the growth rate, δ is the degradation rate (10 % efficiency loss every 12.5 years or 0.008), and t is of course the time in years. Nothing fancy here, just pure exponential growth.

Figure 1: Scenarios for PV cumulative installed capacity as compared

to worldwide demand growth of 4 % per annum over the next 25 years.

As one can see from Figure 1, while the impact of solar may be trivial now, it will not be over the next 25 years. If solar can maintain the same growth rate is has for the past decade, solar can supply

all of mankind's projected electricity demands 26 years from now.

Cost of Photovoltaic-derived Electricity

Generally speaking the cost of any technology declines with production capacity according to a power-logarithm law,

P(t) = Po ρlog2( Exp( γ (t-to) )

where P(t) is the price as a function of time, P

o is the initial price, ρ is the learning rate, and C(t) is the capacity. Historically, ρ for photovoltaics has been very stable around 0.8 which corresponds to a learning rate of 20 % as depicted in Figure 2.

Figure 2: Learning rate for photovoltaic panels (reprinted from [3]).

The learning rate of photovoltaics is much higher than that of other energy technologies. In fact, it's more in-line with things like computers or DVD players. This fact should surprise no one; as I mentioned in the introduction, photovoltaics are different from all other forms of energy production. The small incremental nature of photovoltaics is a major advantage from a R&D perspective, as I've

described previously. While coal and nuclear power plants are installed in increments of hundreds or thousands of megawatts, solar panels are measured in the hundreds of watts. Thus while a design change to a nuclear power plant can take a decade or more to manifest itself, solar manufacturers can do this in weeks. As a result, photovoltaic technology will go through hundreds of design revisions in the time it takes coal or nuclear plants to go through one. Some learning rates for various technologies are listed in Table 1. One thing to take from the table is not only that photovoltaics have a superior learning rate, but that they also have so much further to grow.

Table 1: Historical Learning Rates for Electricity Producing Technologies (extracted from [3]).

| Technology | Learning Rate (%) | Correlation (R2) | Sample Period (years) |

| Coal | 7.6 | 0.90 | 1975-1993 |

| Nuclear | 5.8 | 0.95 | 1975-1993 |

| Hydroelectric | 1.4 | 0.89 | 1975-1993 |

| Gas Turbines | 13 | 0.94 | 1958-1980 |

| Wind | 17 | 0.94 | 1980-1994 |

| Photovoltaic | 20 | 0.99 | 1968-1998 |

| Laser Diodes | 23 | 0.95 | 1982-1994 |

Current panel costs are treading at around $4.80/W

p, and the various extras such as frames, labour cost an addition $2.50/W

p. I'll use two locations to establish a baseline for the cost of photovoltaic power: Stuggart, Germany and Los Angeles, USA. A Retscreen analysis shows that the Stuggard location produces 1.089 MWh/year /kW

p (which represents a capacity factor of 0.17) and LA produces 1.605 MWh/year /kW

p (capacity factor 0.25). Simulations in RETSCREEN find that amortized over 25 years these locations can produce power at $0.24/kWh in Stuggart and $0.21/kWh in California [4]. Financial assumptions are: energy inflation is equal to monetary inflation, interest is 1.0 % above prime (government rates).

World residential electricity prices are generally lower than this [5]. France, which is primarily nuclear, has a rate of $0.144/kWh. The USA, which is coal based, has a mean rate of $0.095/kWh. Canada, which is mostly hydroelectric is one of the lowest at $0.068/kWh; another hydroelectric nation, Norway, comes in at $0.071/kWh. All of these numbers will include associated transmission costs. When we use the growth curves shown previously in Figure 1 with our equation for price, we find that the cost of PV drops below that of conventional electricity generation startlingly fast (Figure 3).

Figure 3: Cost of photovoltaic electricity for Stuggart and Los Angeles versus baselines

Figure 3: Cost of photovoltaic electricity for Stuggart and Los Angeles versus baselines

for France (nuclear-based), USA (coal-based), and Canada (hydroelectric-based).Interestingly, the location of photovoltaics has little impact on their price over the long term. Rather it is the industy's growth rate which dictates the future price. One might be curious as to where the price point might be when the industry saturates.

The actual price decline of PV has stalled over the past year and a half. Essentially what happened is the PV industry eclipsed the microelectronics industry in terms of silicon consumption before thin-film silicon technologies were ready for commercial production. As a result, there's been a bit of a lag as silicon producers catch up to demand. I do not think that this will continue to be a problem, as I will explain below.

Limitations to Growth

For one to look at the curves in the previous sections, and believe that they are achievable then assurances that there won't be too many roadblocks in the future. This section will take a closer look at potential issues that could slow the growth of the photovoltaic industry.

Economic IncentivesOne of the issue with photovoltaics is that as an emergent technology it isn't cost competitive with fossil fuels today. However, subsidy programs by governments of Japan and Germany have been generating tremendous demand growth by making solar cost competitive. Recently more jurisdictions have put forth subsidy programs, such as California, New Mexico, Ontario, Spain, Italy, and Portugal. One obvious question in looking at the exponential growth curves in Figure 1 is, "Just how much is all of this going to cost?" Combining the equations for the learning rate with the growth rate provides us with an answer.

Psubsidy = (Po ρlog2( exp() ) - 0.05)* C(t-to) e(γ-δ)(t-to) / (γ-δ)

This assumes that existing installations are amortized at the same rate as the price of new modules drops. This is not a bad assumption simply due to the massive growth rate, which has a doubling time of 2.1-2.7 years.

Figure 4: Annual cost to subsidize entirety of world PV production to a

Figure 4: Annual cost to subsidize entirety of world PV production to a

rate of $0.05/kWh under 33 % annual growth scenario.

Figure 5: Annual cost to subsidize entirety of world PV production to a rate of $0.05/kWh under 25 % annual growth scenario.

The total cost of these subsidies run to about US$90 billion for the 33 % growth model and US$154 billion for the 25 % model until the price of solar power drops below the desired $0.05/kWh. It's not an insignificant amount of money, but neither is it a particularly onerous cost for transforming our energy structure; the USA alone budgets $24 billion a year to the Department of Energy.

It's probably worth noting that return rate is over one trillion dollars a year by 2031 against the $0.05/kWh baseline. This can be construed either as potential tax revenue or additional income that will be contributed to GDP.

IntermittencyIntermittency is the problem that renewable energy sources suffer from due to the natural fluctuations of their power source. Any transmission grid that relies on renewable sources as a primary input will require a substantial amount of storage, deferrable demand, or load-following spare capacity. The severity of intermittency can be thought of as a combination of its predictability, correlation to demand, and variance. Compared to its chief competitor, wind, solar is far more predictable. One can be assured of the position of the sun in the sky every day with the mitigating factor being cloud cover. However, integrated over a large area the portion of the sky covered with cloud can be reliably estimated. In comparison, wind velocity is nearly impossible to predict. It also correlates relatively well to the natural daily peak in demand, for a noisy real-world system. The variance of wind and solar are roughly equal, which is a little surprising given the dinural cycle of night and day that solar has to deal with. In addition to their daily variance both solar and wind are subject to seasonal variations.

It is my opinion that the concern over intermittency of solar power is exaggerated. This is due to the fact that

the learning rate of photovoltaics dictates that the cost of solar will fall below that of the main established sources of power (coal, nuclear) well before solar will constitute a significant fraction of our energy consumption. I think most people will agree, when the price of solar energy drops below that of the competition, the game changes. When you have power to burn, simple and low-capital techniques of storing or transmitting solar electricity become practical. At $0.05/kWh solar would have a margin of $0.04/kWh or more to work within for charging electric vehicles, filling deferrable demand, storage techniques such as

Vanadium redox batteries, or long distance high-voltage direct-current transmission.

Resource LimitationsOne of the factors limiting photovoltaic growth at the moment is a shortage of electrical-grade refined silicon. Silicon itself is not in short supply, being the second most abundant element in the Earth's crust after Oxygen. This limitation is likely to fall away as new cell designs that use less silicon are deployed commercially. Traditional cells are made by sawing a solid block of polycrystalline silicon and then polishing the surfaces. This results in a cell that is 300 μm with around 50-100 μm of material wasted. New techniques such as

ribbon growth can reduce that figure to 100 μm. Furthermore, thin film silicon cells grown by

chemical vapour deposition, such as

Sharp's triple-junction cells, can achieve the same performance as polycrystalline cells with only 10 μm of silicon. As these techniques reach market penetration (ribbon growth is proprietary, thin-film techniques are not), they should reduce the strain on silicon refiners.

The other resource restriction is due to geographical limitations. Some renewable resources (hydroelectric, tidal) are tightly limited to certain terrain, such as tidal basins or river valleys. Wind is a somewhat more diffuse, but the best resources where the wind blows most strongly and consistently are still limited compared to humankind's energy consumption.

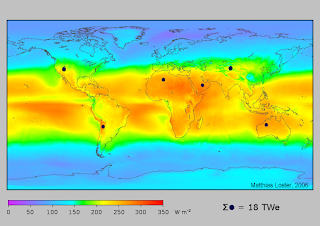

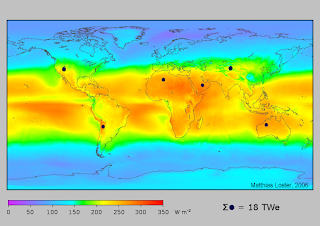

Figure 6: Global Solar Energy Abundance Map [6].

Figure 6: Global Solar Energy Abundance Map [6].World insolation (incoming solar radiation) on the other hand is massive and relatively evenly distributed. The sun outputs 10

26 watts of power and our tiny little planet intercepts about a billionth of that. Right now the human race consumes around 18 TW of energy, or 1/10,000th of what strikes the Earth. Roughly 1/3rd of that is useful work, the rest is lost to entropy. The 24-hour average insolation for the inhabited world spans 150-300 W/m

2. That implies we would need 3.5-7 m

2 of 10 % efficient panels per person, to supply all of our energy needs from solar power.

Personnel ShortfallRunning short of trained people in a rapidly growing industry is always presents a problem. Take, for example, nuclear engineers. There aren't many of them, training one takes about four years, and their skills are not easily transferred to other disciplines. The photovoltaics industry is similar enough to the microelectronics industry that they can trade personnel, however. The microelectronics industry has already built up strong education programs that photovoltaics can piggy-back.

If chemical vapour deposition (CVD) for thin-film silicon becomes the dominant production method, this still should not present too great a problem. CVD is a common manufacturing technique used for all sorts of coatings, such as tribological (hardness) coatings for tools, or even aluminized mylar. It's also used in microelectronics. It does happen to be more of an art then a science, which means that learning requires experience.

Ancillary CostsInstalling a rack of PV modules on a garage is not simply a matter of fixing them down with some twist-ties. Typically they need a metal frame so they present an optimum azimuth to the sun, they need electrical wiring, they need an inverter to transform DC to AC power, they may need a net-meter to sell power back to the utility, and of course, there's the labour required for installation. As many readers will know, there's quite an argument in California as to whether or not a licensed electrician is required for installations. One might also consider the 3 mm layer of glass (glazing) that protects the cells from hail also 'ancillary' although it is included in the sticker price.

The main question is whether or not ancillary costs have a similar learning rate to that of the modules themselves. My analysis has assumed that they do. We will probably see declines in the ancillary costs by better product integration and standardization. Rugged encapsulation combined with light-trapping surface patterning will probably slowly replace the standard glazing. Inverters should improve drastically both in terms of cost and lifespan. There's also always been the idea of incorporating solar cells into dual-use products, such as solar shingles or skylights.

Consumer AcceptanceUnlike just about every other source of electrical generation, photovoltaic power doesn't have any "Not In My Backyard" (aka NIMBY) issues. `Nuff said.

Conclusions

Many people will look at the graphs in disbelief that the easy path photovoltaic power has been travelling can continue. All I can really say in reply is, those are the historical numbers. The learning rate is exceptionally stable. The growth rate has been, if anything, accelerating in the face of a industry silicon shortage. Thin-film technologies seem well positioned to cause the price to continue to fail into the near future. Solar power doesn't have very far to fall in many European nations before it's cheaper than residential rates. As residential solar becomes the cheapest power available that will continue to push demand upward and fuel growth. There's nothing obvious to me that says 'Stop' in solar's future and it's a fact of exponential growth that the early years matter the most. Even if the growth rate drops 1 % a year over the next 25-years the eventually outcome seems predetermined, it's just a question of the timing.

References

[1] S. Pajjuri, M. Heller, Y.S. Tien, I. Tu, B. Hodess,

"Solar Wave - Apr-07 Edition" Merill Lynch (2007).

[2] W. Hoffmann,

"PV solar electricity industry: Market growth and perspective", Solar Energy Materials & Solar Cells 90 (2006), pp. 3285-3311.

[3] A. McDonald, L. Schrattenholzer, "

Learning rates for energy technologies", Energy Policy 29 (2001), pp. 255-261.

[4]

RETScreen International Clean Energy Project Analysis Software, National Resources Canada.

[5]

Electricity Prices for Households, Energy Information Administration, February 28,2007.

[6] Matthias Loster,

Solar land area, Wikipedia.org, 2006.